Cookie settings on the website

History of MKB Bank

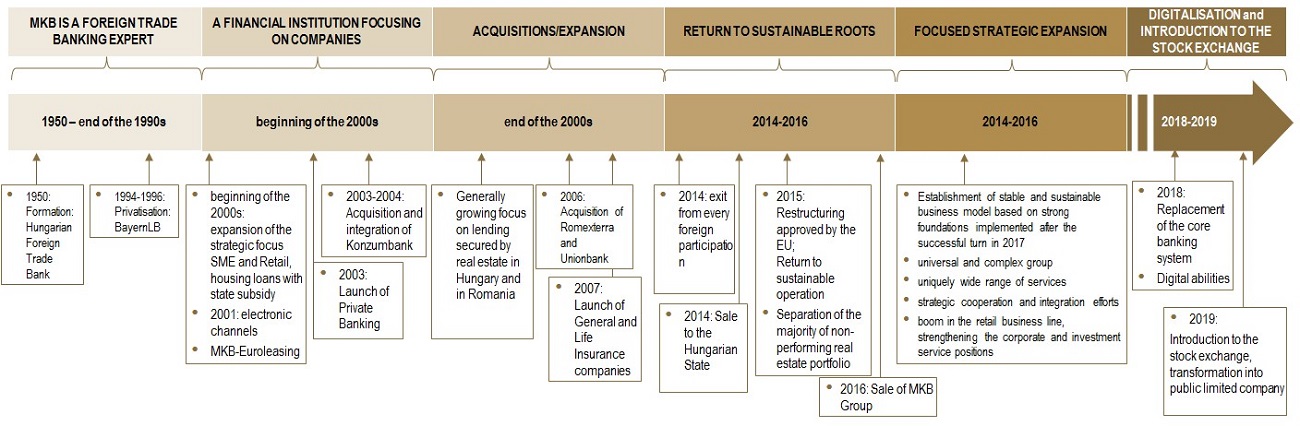

The Bank was founded by the Hungarian State on 12 March 1950 under the name of Magyar Külkereskedelmi Bank Rt. The objective of its establishment was participation in the international payments, primarily the performance of foreign trade related banking tasks. Its scope of activities expanded shortly with the tasks of organising, controlling, financing and performing complex foreign trade transactions. In the course of the banking reform of 1987, when the two tier banking system was established, the Bank obtained a full commercial banking licence, based on which, in addition to strengthening the traditional business lines, it successfully launched and developed new business lines. Complex service to domestic companies shortly became the core activity of the Bank. The Bank built its branch network gradually from the end of the eighties. The Bank launched retail banking services at the end of the 1980s and significantly developed the retail banking service, money and FX market and capital market activities at the beginning of the 1990s.

The privatisation of the Bank was performed in several steps in the 1990s. Following the acquisition of the first share package in 1994 Bayerische Landesbank gradually increased its participation in the Bank in the following years and became the main owner of the Bank. As a result of the new growth period following the privatisation the Bank became and influencing player of the Hungarian market. Business policy opening to the small and medium size enterprises and to wider layers of retail customers was an important change in the activity of the Bank from the beginning of the 2000s, which also meant the development of such new priority business lines as mortgage lending and vehicle financing. By the integration of the investment service activity in 2001 the Bank became a universal credit institution.

In harmony with its business policy objectives the Bank acquired 99.6% of the shares of Konzumbank Rt. at the end of 2003. In 2004 Konzumbank Rt. was merged into the Bank.

In May 2006 the Bank acquired majority participation in the Bulgarian MKB Unionbank A.D and in October 2016 in the Romanian Nextebank S.A. (previous company name: MKB Romexterra Bank S.A.) In 2012 the European Commission approved the reorganisation plan of the then owner Bayerische Landesbank, pursuant to which the Bank sold its foreign subsidiaries until April 2014.

By acquiring the total participation of the Bayerische Landesbank on 29 September 2014 the Hungarian State became 99.99% owner and by procuring the minority participation on 14 October 2014 it acquired 100% participation in the Bank.

On 18 December 2014 pursuant to Article 17 (1) of the Resolution Act NBH ordered the resolution of the Bank and pursuant to Article 84 (1) b) it took over the exercising of the owners’ and board of directors’ rights.

At the end of 2015 significant portion of the commercial real estate portfolio causing serious losses in the previous years was separated from the Bank with asset separation, which was purchased by MSZVK Magyar Szanálási Vagyonkezelő Zrt. at a so-called economic value, a price exceeding the market price, with the approval of the European Commission. In exchange for the generated approved state aid MSZVK Magyar Szanálási Vagyonkezelő Zrt. acquired 100% direct ownership share in the Bank, however the rights of owners were still exercised by NBH.

The open, transparent, non-discriminative sale process closely monitored by the European Commission was successfully closed after meeting the conditions - including the approval of acquisition of influence by the members of the winner syndicate - and the payment of the purchase price on 29 June 2016. On 30 June 2016 after the full implementation of the resolution objectives NBH terminated the resolution procedure of the Bank.

In order to offset the state aid granted in connection with the asset separation performed within the framework of the resolution process the Hungarian authorities undertook the performance of overall commitment undertaking framework system, which the Bank must fully comply with. The obligation of the Bank in the course of the reorganisation period ending on 31 December 2019 covers the implementation of the Restructuring Plan approved by the European Commission. The main objectives of these undertakings are the maintenance of the long term viability of the Bank and the MKB Group as well as the limitation of the competition distorting effects. Among the commitments there is the one, according to which the Bank must be transformed into a public company and it must be introduced on a regulated capital market until the end of 2019. The Bank regularly reports about the implementation of the commitments to the European Commission.

The public version of the text of the commitment undertaking framework system is available at the following internet website of the Directorate-General for Competition of the European Commission: http://ec.europa.eu/competition/state_aid/cases/261437/261437_1721348_166_2.pdf

The 2016 business year was the year of successful renewal for the Bank: while the reorganisation process lasting one and a half years was closed, the financial processes stabilised again and the foundations of long term growth were laid down. The management of the Bank renewed the strategy, organisation and operation of the Bank and set the MKB Group on growth path, which after 6 loss-making years became profitable in 2016 and realised a profit after tax well exceeding the plans.

In 2017 the management targeted the repositioning of the Bank: by the successful implementation of the new strategic directions the Bank wishes to become a dominant player of the Hungarian market again. In addition to the dynamisation of the traditional business areas the strategic directions specified significant objectives related to the Bank’s entrance to the digital space. The fact that MKB Group could double the profit of the previous year in 2017 largely supported the implementation of the strategy. It became clear that the Bank was on a long term growth path. The operation of MKG Group also strengthened, which was completed by the subsidiaries.

2018 was the year of implementing the 2021 medium term strategy of MKB and the performance of the EU commitments (commitments constituting parts of the Restructuring Plan). The key event of the year was the replacement of the core system of the bank, by which the Bank implemented full digital changeover. During all this the profit of MKB Group grew significantly and exceeded the plans.

By its resolution No. 13/2019 (17 January) the General Meeting of the Bank decided about the preparation for the introduction of series “A” ordinary shares on BSE and about changing the form of operation to public limited company subject to Introduction on the Stock Exchange. The General Meeting asked the Board of Directors to take the necessary action to prepare the introduction of series “A” ordinary shares on BSE.

On 27 May 2019 by its resolution No. H-KE-II-353/2019 NBH approved the Listing Prospectus for the introduction of MKB shares on the Budapest Stock Exchange.

As of 30 May 2019 BSE registered the MKB shares at its product list. As of the day of the introduction of the stock exchange the change in the company form was also registered by the Court of Registration. From this date the name of the Bank is MKB Bank Plc. The amended Statutes of the Bank took effect on the same day.

Pursuant to resolution No. 186/2019 of the chief executive officer of BSE the MKB shares were classified in the Standard category of the share section of BSE at listing price of HUF 1972/share. The first trading day of the MKB shares took place on 17 June 2019.

Important Notice:

Hungarian language is the official and registered language of MKB Bank Nyrt.’s („the Issuer”) disclosures pursuant to the relevant legal and stock-exchange rules. The present English translation has been prepared on a voluntary basis, with the best care and intention of the Issuer to inform English speaking investors, however, in the event of any controversy between the Hungarian and English version, the authentic Hungarian version shall prevail.

Tisztelt Ügyfelünk!

Ezúton tájékoztatjuk Önt, hogy az MKB Bank Nyrt. és a Takarékbank Zrt. – a Takarékbank Zrt. beolvadásával – 2023. április 30-án egyesült, és az így létrejött kereskedelmi bank, mint a Magyar Bankholding bankcsoport anyabankja 2023. május 1-jétől MBH Bank Nyrt. (a továbbiakban: MBH Bank) név alatt működik tovább.

Tisztelt Ügyfelünk!

Ezúton tájékoztatjuk Önt, hogy az MKB Bank Nyrt. és a Takarékbank Zrt. – a Takarékbank Zrt. beolvadásával – 2023. április 30-án egyesült, és az így létrejött kereskedelmi bank, mint a Magyar Bankholding bankcsoport anyabankja 2023. május 1-jétől MBH Bank Nyrt. (a továbbiakban: MBH Bank) név alatt működik tovább.

Tisztelt Ügyfelünk!

Ezúton tájékoztatjuk Önt, hogy az MKB Bank Nyrt. és a Takarékbank Zrt. – a Takarékbank Zrt. beolvadásával – 2023. április 30-án egyesült, és az így létrejött kereskedelmi bank, mint a Magyar Bankholding bankcsoport anyabankja 2023. május 1-jétől MBH Bank Nyrt. (a továbbiakban: MBH Bank) név alatt működik tovább.